Calculate diminishing value depreciation

Find the depreciation rate for a business asset. Use this calculator to calculate an accelerated depreciation of an asset for a specified period.

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Definition

Closing balance opening balance depreciation amount.

. Using the same example where the asset has cost 80000 and has an effective life of 5 years the method to calculate diminishing value depreciation is as shown below. Diminishing value method. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

Cost value 10000 DV rate 30 3000. 2000 - 500 x 30 percent 450. Depreciation amount 1750000 12 210000.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Then subtract the post-accident value of your car from the pre-accident value of your car and that will give you the actual diminished value. Prime cost straight line method.

Year 2 2000 400 1600 x. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years. 2 Methods of Depreciation and How to Calculate Depreciation.

Depreciation - 10500 calculated from 1306 300606 - But only 4 months. Declining balance depreciation is where an asset loses value by an annual percentage. For instance a widget-making machine is said to depreciate.

You can use this tool to. The depreciation rate is 60. And the residual value is.

So using the example from earlier. Depreciation Expenses Net Book Value. Option 2 - 6995 - Professionally formatted printable report for submission to.

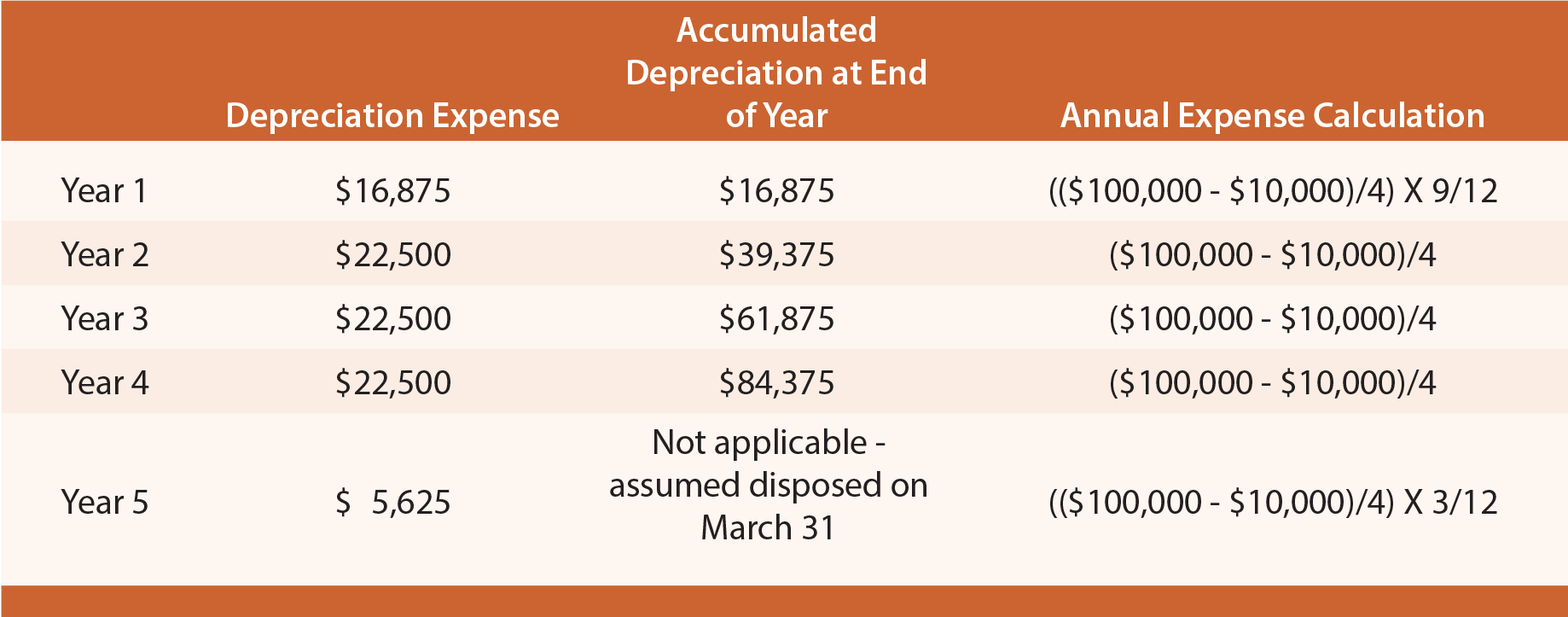

Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the. Diminishing Balance Method Example.

Option 1 - 1995 - Basic on-screen indication of the diminished value your vehicle has incurred. Calculate depreciation for a business asset using either the diminishing value. Year 1 2000 x 20 400.

Calculator for percentage depreciation with a declining balance. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. This would be applicable for both Straight Line and Diminishing Value depreciation.

Well here is the formula. For example if an asset is worth 10000. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method.

Depreciation amount opening balance depreciation rate. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this. When using this method assets do not depreciate by an equal.

22 Diminishing balance or Written down. Depreciation rate finder and calculator. Another common method of depreciation is the diminishing value method.

Use the diminishing balance depreciation method to calculate depreciation expenses.

Depreciation Diminishing Value Method Youtube

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Methods Principlesofaccounting Com

Accumulated Depreciation Definition Formula Calculation

Depreciation Expense Calculator Flash Sales 53 Off Www Ingeniovirtual Com

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

How To Calculate Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Definition Formula

Depreciation Rate Formula Examples How To Calculate

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Formula Guide To Calculate Depreciation

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Double Declining Balance Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

How To Use The Excel Db Function Exceljet