Discount and tax calculator

Weighted Average Cost of Capital Calculator. Claiming CTC or RRC.

How To Calculate Taxes And Discounts Basic Concept Formulas And Examples Cuemath

6 hours agoIncome tax calculator.

. You can easily calculate tax and discount. Original Price Discount Amount Sale Price. Days to pay before payment is late Days left in the discount period 4.

You can also use it for the reverse and calculate the size of the discount or the original price. Discount and Tax Calculator. Our Resources Can Help You Decide Between Taxable Vs.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 10 of 45 010 45 450 45 450 4050 or 90 of 45 090. 10 days in total discount period minus the 6 days since the invoice was submitted.

Easy to input calculator with sales and tax inputs. For those with lower than typical bills the increase will be lower. Our tax refund calculator will show you how.

Then use this number in the multiplication process. Percentage Discount doesnt matter the result is. Up to 4 levels of discount can be applied.

Editable shopping list with export feature. Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Percentage Off Calculator To calculate a particular percent off the user enters these two values.

Tip Sales Tax Calculator Number of Participants Subtotal Sales Tax pct flat Tip Amount pct flat exclude tax from tip round up payment Grand Total Total Bill Subtotal Sales Tax 0 Total Tip 0 Each Pays Sales tax of 0 towards 000 is. An online discount calculator is the smart tool that helps to calculate discounted price after applying discount and sales tax on the specific product. 120 30 90.

Delaware DE Transfer Tax. As a shopper you it also functions as a sale price calculator to help you negotiate the price. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal.

This discount calculator allows you to find the reduced price of a product and the amount of money you save. Apart from it this original price calculator use to find the reverse percentage and even calculate the size of the discount or the original price of a discounted item. Discount Calculator will help you at shopping.

Coupon and sales reminders with image capture. Just enter the price and type the discount rate. Discover Helpful Information And Resources On Taxes From AARP.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Credit card.

About this app. 12000 025 30. Over a year multiply current costs by 65 each 100 becomes 10650 this includes the 400 discount but not other payments.

You can also use this app to calculate taxes only. For example if a good costs 45 with a 10 discount the final price would be calculated by subtracting 10 of 45 from 45 or equivalently calculating 90 of 45. The discount calculator supports many languages.

Original Price Discount Rate Discount Amount. You would enter these numbers in the calculator. The discount amount is calculated as follows.

How Income Taxes Are Calculated First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. Itemized deductions are a list of eligible expenses that also reduce your taxable income. Stock Non-constant Growth Calculator.

Holding Period Return Calculator. Free tax code calculator. Sales Tax reference guide for US only.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. The most flexible accurate and unique tax and discount calculator ever. Option to choose to apply Dollar Amount Discount before or after tax.

Your tax bracket is determined by your taxable income and filing status. The State of Delaware transfer tax rate is 250. The sale price is calculated as follows.

Discount Calculator quickly detect how much you will save. You may also be interested in our Shopping. The discount amount is 30 and the sale price is 90.

Some areas do not have a county or local transfer tax rate. Itemized deductions Standard deductions lower your income by one fixed amount. Compare your estimated savings to the register to make sure they get the price right.

Discount the vendor is offering. Enter Gross Amount Enter Percent Off discount Set the other three inputs to 0 To figure out what percent off a discount is the user has these options Enter 0 for Percent Off discount Enter the Gross Amount. Find list price and tax percentage Divide tax percentage by 100 to get tax rate as a decimal.

Inheritance tax planning. Turning the percentage into a decimal by dividing it by 100 Total days in the payment period. How to Calculate Sales Tax Multiply the price of your item or service by the tax rate.

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

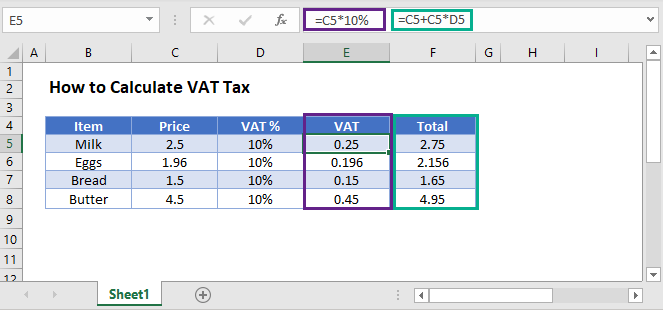

How To Calculate Vat Tax Excel Google Sheets Automate Excel

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Sales Tax Calculator

Reverse Sales Tax Calculator 100 Free Calculators Io

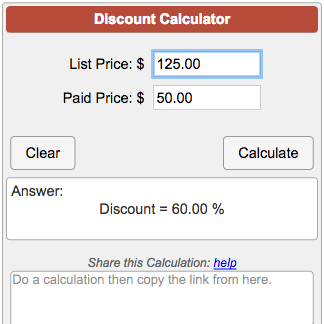

Discount Calculator

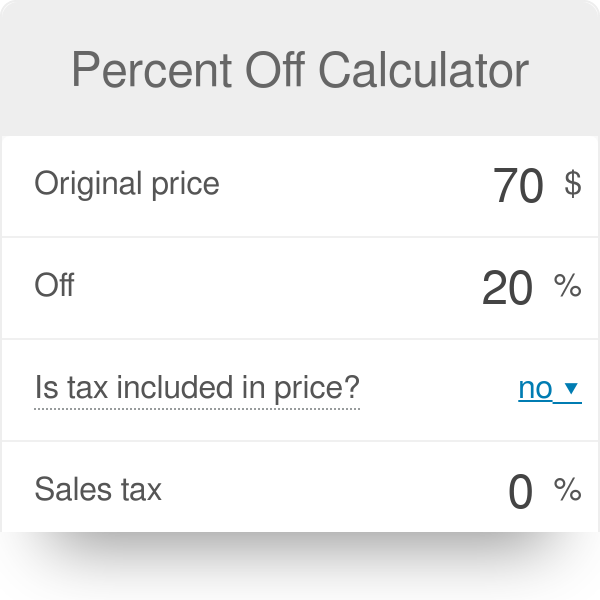

Percent Off Calculator

How To Calculate Cannabis Taxes At Your Dispensary

Reverse Sales Tax Calculator

Tip Sales Tax Calculator Discount Calculator Calculator Sales Tax

Calculator Tax Vat And Gst Apps On Google Play

How To Calculate Cannabis Taxes At Your Dispensary

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

How To Calculate Sales Tax Definition Formula Example

Tip Sales Tax Calculator Salecalc Com

Llc Tax Calculator Definitive Small Business Tax Estimator

Sales Tax Calculator